vermont state tax brackets

Over 85 million taxes filed with TaxAct. Vermont State Tax Brackets.

Historical Vermont Tax Policy Information Ballotpedia

Before sharing sensitive information make sure youre on a state government site.

. State of Vermont Department of Taxes Taxpayer Services Division PO. The Vermont State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Vermont State Tax CalculatorWe also provide. Box 547 Montpelier VT 05601-0547 Emailtaxbusinessvermontgov Phone.

These income tax brackets and rates apply to Vermont taxable income earned January 1 2020. 2017 VT Tax Tables. Single tax brackets generally result in higher taxes when compared with taxpayers with the same income.

The combined federal and state marginal tax rate in the highest. How to Calculate 2022 Vermont State Income Tax by Using State Income Tax Table. These income tax brackets and rates apply to.

Taxes in Vermont Vermont Tax Rates. The site is secure. This form is for income earned in tax year 2021 with tax returns due in April 2022We.

Start filing for free online now. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. The state income tax system in vermont is a progressive tax system.

Vermont Income Tax Rate 2020 - 2021. Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. Vermont has 4 tax brackets and 4 corresponding tax rates.

The lowest tax rate is 335 and the highest tax rate is 875. Here is a list of current state tax rates. TAX DAY NOW MAY 17th.

Ad Import tax data online in no time with our easy to use simple tax software. These taxes are collected to provide essential state functions resources and programs to benefit both our taxpayers and Vermont at large. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66.

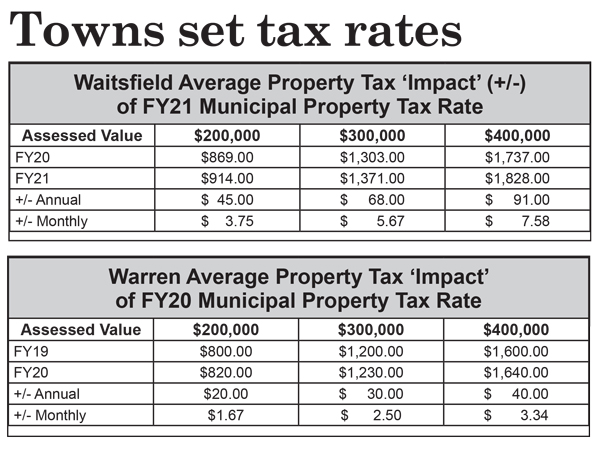

Rates range from 335. 2019 Income Tax Withholding Instructions Tables and Charts. The major types of local taxes collected in Vermont include income property and sales taxes.

Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. 2016 VT Rate Schedules and Tax Tables.

Find your pretax deductions including 401K flexible account. Every state with an income tax as well as the IRS support the Single filing status. Exact tax amount may vary for different items.

Start filing your tax return now. Detailed Vermont state income tax rates and brackets are available on this page. Vermont also has a 600 percent to 85 percent corporate income tax rate.

2022 Vermont state sales tax. Income tax tables and other tax. Vermont Income Taxes.

2017 VT Rate Schedules. Before sharing sensitive information make sure youre on a state government site. Tax Bracket Marginal Corporate Income Tax Rate.

Tax Bracket Tax Rate. This page has the latest Vermont brackets and tax rates plus a Vermont income tax calculator. The Vermont State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Vermont State Tax CalculatorWe also provide.

This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. 2021 Tax Brackets and Income ranges will be listed here as they become available. The latest available tax rates are for 2020 and the vermont income tax brackets have.

Find your income exemptions. We last updated Vermont Tax Rate Schedules in March 2022 from the Vermont Department of Taxes. Vermont Tax Brackets for Tax Year 2021.

Vermont collects a state corporate income tax at a maximum marginal tax rate of 8500 spread across three tax brackets. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76. 2017-2018 Income Tax Withholding Instructions Tables and Charts.

State government websites often end in gov or mil. Vermonts income tax brackets were last changed two. The Vermont Single filing status tax brackets are shown in the table below.

The site is secure. Vermonts 2022 income tax ranges from 335 to 875. These income tax brackets and rates apply to Vermont taxable income earned January 1 2020 through December 31 2020.

State government websites often end in gov or mil. The latest Vermont state income tax brackets table for the Married Filing Jointly filing status is shown in the table below.

Vermont Corporate Income Tax Rate 12th Highest Vermont Business Magazine

States With Highest And Lowest Sales Tax Rates

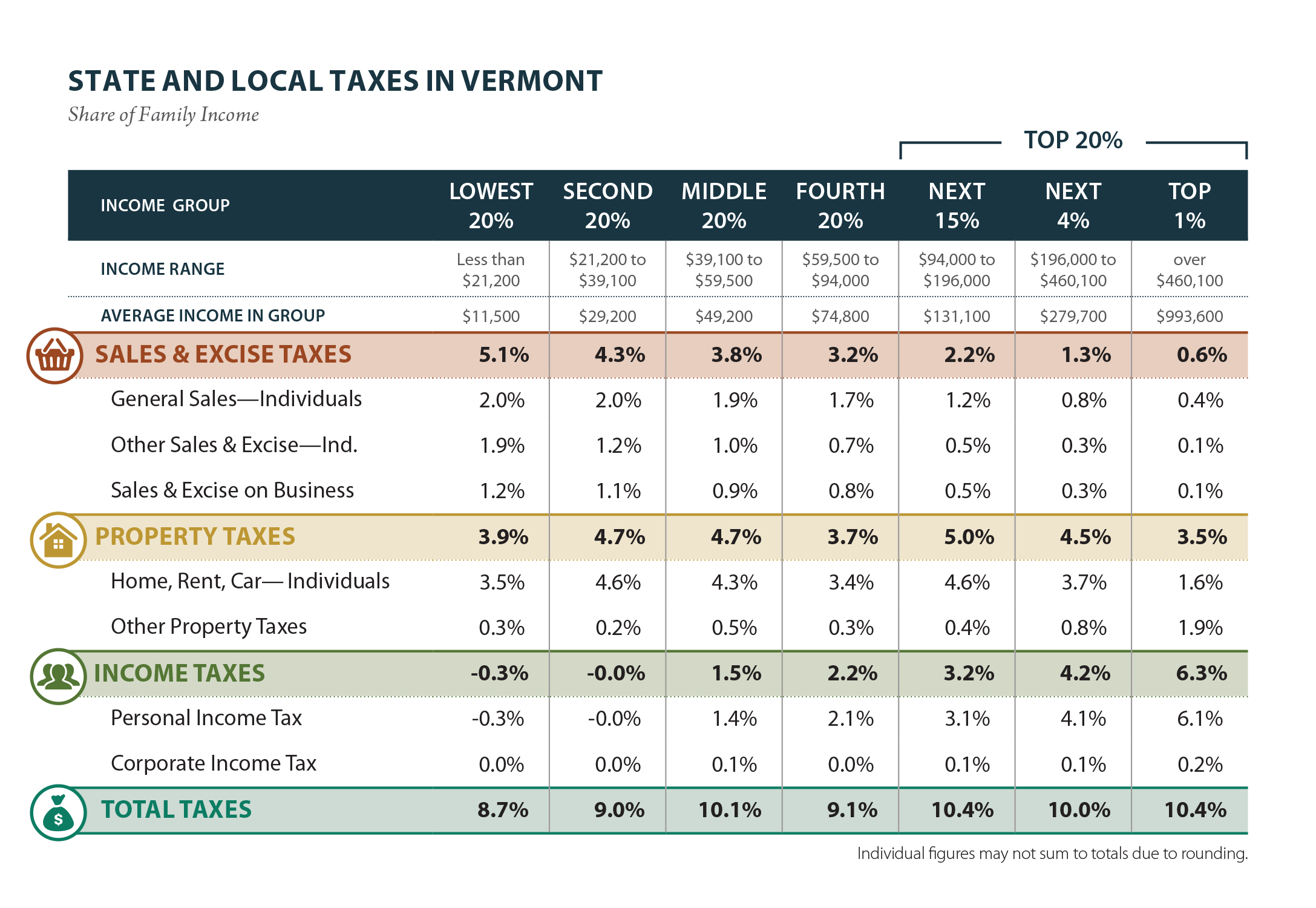

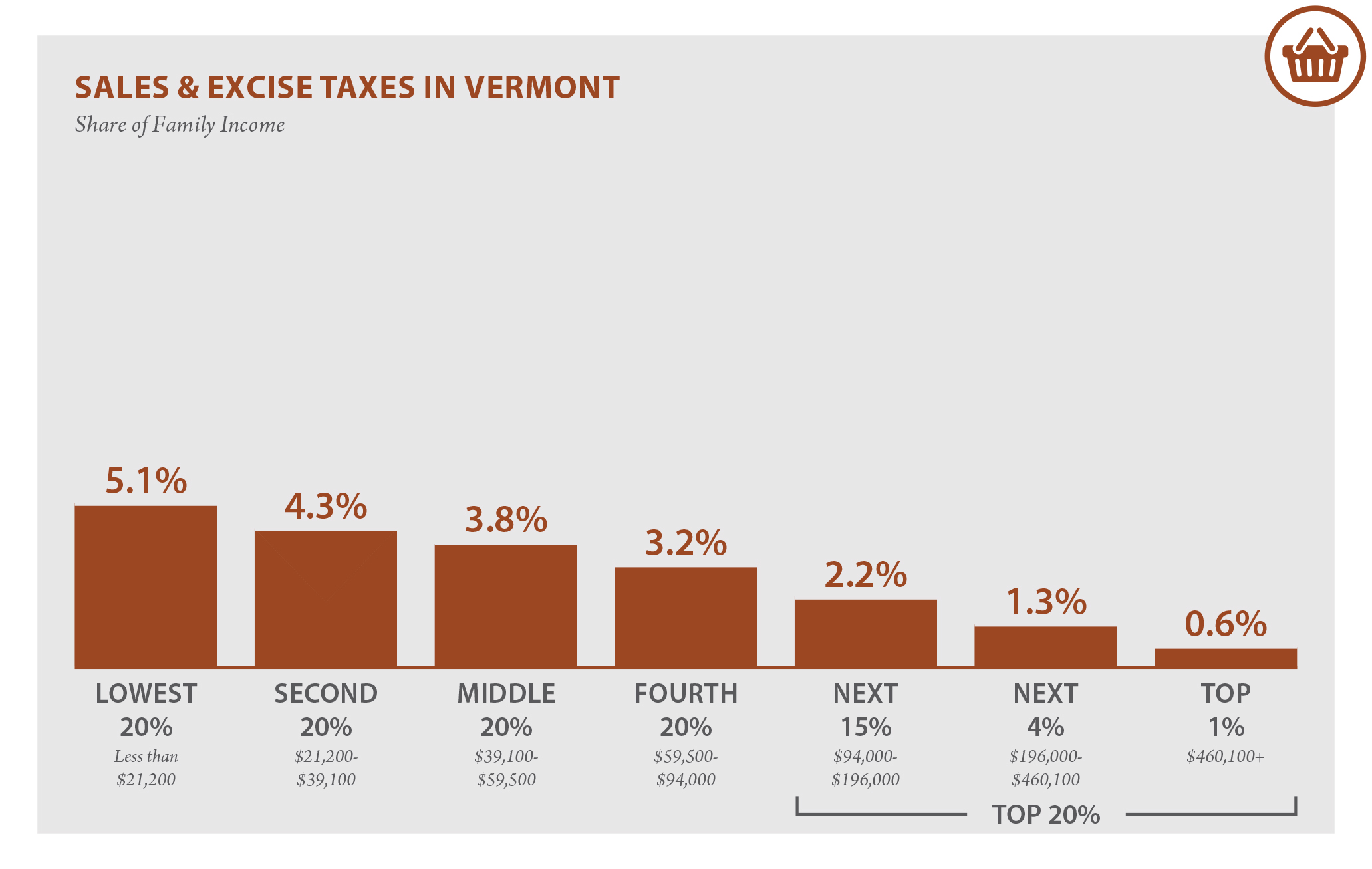

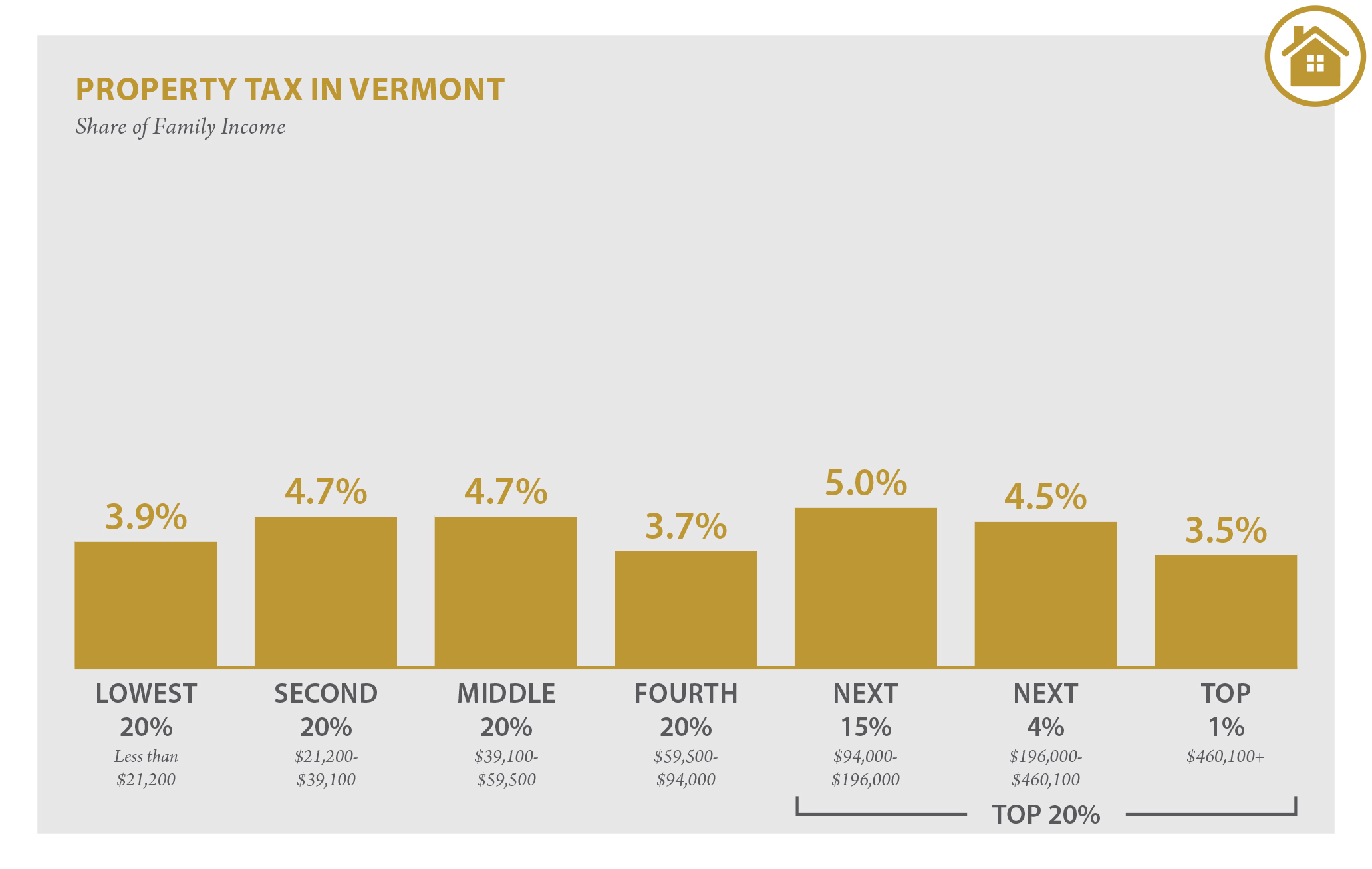

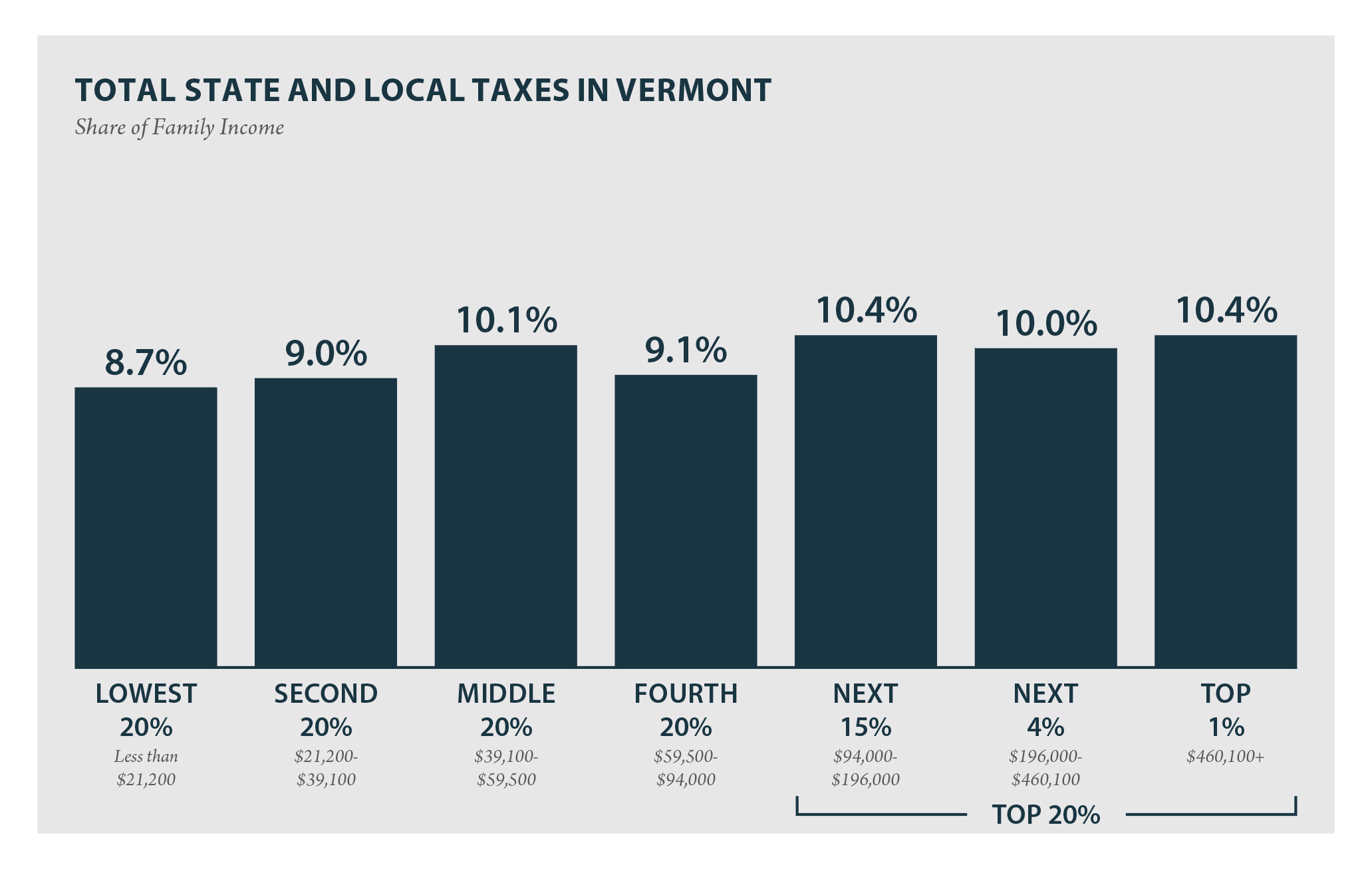

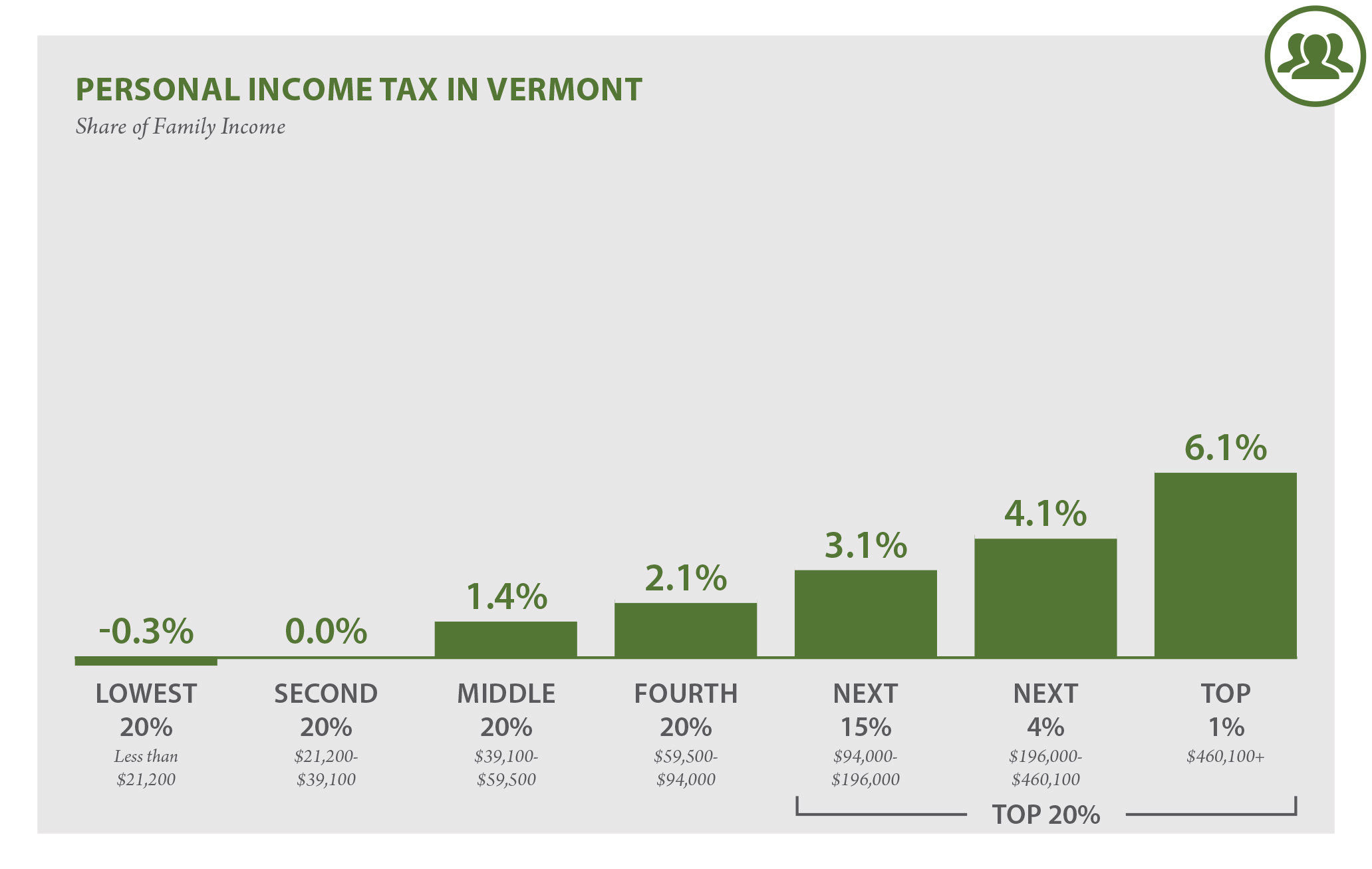

Vermont Who Pays 6th Edition Itep

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Who Pays 6th Edition Itep

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Vermont Sales Tax Small Business Guide Truic

Vermont Who Pays 6th Edition Itep

Vermont S Income Taxes Are Lower Than Many Other States Public Assets Institute

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Vermont Who Pays 6th Edition Itep

State Corporate Income Tax Rates And Brackets Tax Foundation

The Most And Least Tax Friendly Us States

Vermont Property Tax Rates Nancy Jenkins Real Estate

Vermont Income Tax Vt State Tax Calculator Community Tax